How Insurance Account can Save You Time, Stress, and Money.

Wiki Article

The Facts About Insurance Advisor Revealed

Table of ContentsInsurance Commission Fundamentals ExplainedThe Main Principles Of Insurance Agent Job Description The Ultimate Guide To Insurance AdsWhat Does Insurance Ads Do?The 8-Second Trick For Insurance And Investment

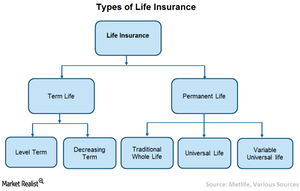

Various other sorts of life insurance policyTeam life insurance policy is commonly provided by companies as part of the business's office benefits. Premiums are based on the group as a whole, instead than each person. In basic, employers use basic coverage totally free, with the choice to acquire supplementary life insurance if you require more coverage.Mortgage life insurance coverage covers the present equilibrium of your home mortgage and pays out to the lending institution, not your family members, if you die. Second-to-die: Pays out after both insurance policy holders die. These policies can be used to cover estate tax obligations or the treatment of a reliant after both insurance holders pass away. Frequently asked questions, What's the best type of life insurance to get? The very best life insurance policy for you comes down to your demands and also spending plan. Which types of life insurance coverage deal versatile premiums? With term life

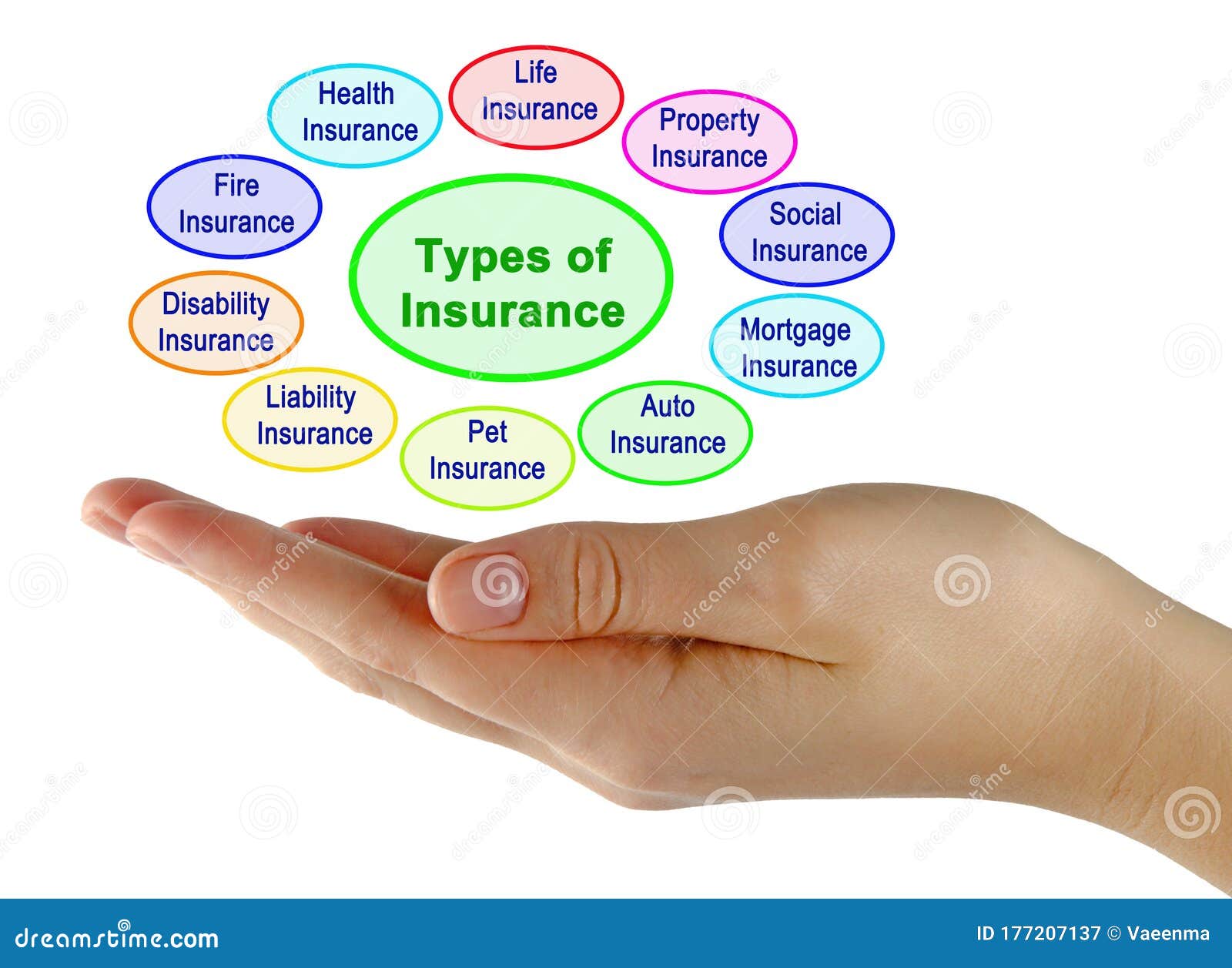

insurance coverage as well as whole life insurance policy, premiums usually are dealt with, which suggests you'll pay the very same quantity on a monthly basis. The insurance policy you require at every age differs. Tim Macpherson/Getty Images You need to purchase insurance coverage to safeguard yourself, your family, as well as your riches. Insurance coverage could save you hundreds of dollars in case of a crash, illness, or catastrophe. Medical insurance and also automobile insurance coverage are required, while life insurance policy, homeowners, occupants, as well as impairment insurance coverage are motivated. Obtain begun free of charge Insurance isn't the most awesome to believe around, however it's neededfor safeguarding on your own, your household, and also your wide range. Mishaps, illness, as well as disasters happen constantly. At worst, occasions like these can plunge you right into deep monetary destroy if you do not have insurance coverage to draw on. Plus, as your life modifications(say, you get a brand-new job or have a child)so ought to your insurance coverage.

Excitement About Insurance Ads

Below, we have actually described briefly which insurance policy protection you ought to highly consider getting at every phase of life. Once you leave the functioning globe around age 65, which is typically the end of the lengthiest policy you can purchase. The longer you wait to acquire a plan, the greater the eventual expense.If somebody else counts on your earnings for their economic wellness, after that you probably require life insurance policy. The finest life insurance policy for you depends on your spending plan as well as your financial goals. Insurance policy you need in your 30s , Home owners insurance coverage, House owners insurance coverage is not called for by state law.

Fascination About Insurance And Investment

-If, however, you endure the term, no cash will certainly be paid to you or your family. -Your family members receives a particular amount of money after your fatality.-They will certainly likewise be qualified to a bonus that often builds up on such amount. Endowment Plan -Like a term plan, it is also valid for a certain period.- A lump-sum quantity will be paid to insurance estimate your household in case of your death. Money-back Policy- A particular percentage of the sum assured will be paid to you occasionally throughout the term as survival advantage.-After the expiry of the term, you get the equilibrium quantity as maturity proceeds. -Your family members obtains the whole amount guaranteed in case of fatality throughout the policy period. The amount you pay as costs can be subtracted from your overall gross income. This is subject to an optimum of Rs 1. 5 lakh, under Area 80C of the Income Tax Act. The premium quantity made use of for tax deduction must not go beyond 10 %of the amount assured.What is General Insurance coverage? A general insurance coverage is a contract that supplies monetary compensation on any browse around these guys kind of loss other than fatality.

Get This Report on Insurance Asia Awards

Your wellness insurance coverage took treatment of your treatment prices. As you can see, General Insurance coverage can be the answer to life's numerous problems. Pre-existing conditions cover: Your wellness insurance coverage takes care of the therapy of conditions you may have prior to purchasing the wellness insurance policy.Two-wheeler Insurance coverage, This is your bike's guardian angel. It's comparable to Automobile insurance policy. You can not ride a bike or scooter in India without insurance coverage. Just like vehicle insurance, what the insurance company will certainly pay depends upon the kind of Discover More Here insurance coverage and also what it covers. 3rd Party Insurance Policy Comprehensive Vehicle Insurance Policy, Compensates for the damages created to another individual, their automobile or a third-party home.-Damage triggered as a result of man-made activities such as riots, strikes, and so on. Residence framework insurance This secures the framework of your residence from any kinds of threats and damages. The cover is likewise included the irreversible components within your home such as bathroom and kitchen installations. Public liability coverage The damage caused to another person or their residential property inside the insured residence can additionally be made up.

Report this wiki page